Frustrated and Tired of running around with NO RESULTS? SERVICE IS OUR LANGUAGE

We find REAL listings within YOUR criteria. Research tailored for YOUR NEEDS!

Trained in the USA! Means YOU, the client, are put first! contact us

THE LATEST NEWS FOR THE REAL ESTATE MARKET

Globes Arik Mirovsky November 27, 2022

Globes Arik Mirovsky November 27, 2022

Sarona – Israel’s top socioeconomic neighborhood

Six of the ten highest ranked neighborhoods are in Tel Aviv, while nearly half of the lowest ranked neighborhoods are in Jerusalem.

Tel Aviv’s Sarona is the best neighborhood in Israel, in terms of socioeconomic parameters, the Central Bureau of Statistics reports. Sarona is followed by Tel Aviv’s Tzahala neighborhood and Haifa’s Denya. According to the report, the worst neighborhoods in Israel in socioeconomic terms are the ultra-Orthodox areas of Bnei Brak, Beit Shemesh and Jerusalem. Tel Aviv has significantly increased its representation in the top ten since the last report (six of the top ten), while Jerusalem has continued to increase its representation in the lowest socioeconomic neighborhoods.

The Central Bureau of Statistics examines the socioeconomic level of the population through a combination of the characteristics of the population in the areas of demographics, education and training, standard of living, employment and pensions. For example, the final weighting includes factors such as the median age of the residents, the percentage of families with a large number of children, years of schooling, academic degrees, employment, average income, average number of vehicles per family, and also average time spent abroad. From all these a final mark is calculated for each neighborhood.

In total there are 78 neighborhoods in Israel with a mark of ten, of which 39 are in Tel Aviv, nine are in Haifa, six in Ramat Hasharon, four are in Ramat Gan and three are in Modi’in. Since the last report in 2017, 17 more neighborhoods have received a mark of 10.

After Sarona, Tzahala and Denya, the neighborhoods with the highest marks in the 10 category are Bitzaron West (Tel Aviv), Park Tzameret (Tel Aviv), Afeka (Tel Aviv), Neve Gan (Ramat Hasharon), Reut North (Modi’in-Reut-Maccabim), Reut South (Modi’in-Reut-Maccabim), and Hamishtala (Tel Aviv).

Also in the highest 10 category are the Reichman University neighborhood in Herzliya and Neve Afek in Rosh Ha’ayin. But Herzliya Pituah has been relegated from the 10 category to nine in this latest reports as has the southern part of Haifa’s Vardiya neighborhood.

115 Israeli neighborhood were ranked in the lowest category of which 54 are in Jerusalem, 16 in Bnei Brak, nine in Modi’in Illit and nine in Rahat. Tel Aviv has one neighborhood in the lowest category – a small neighborhood with 269 residents between Derekh Moshe Dayan and Derekh Hahagana.

Mortgage lending decline continues

Mortgage lending decline continues

Globes by Arik Milovsky November 13, 2022

The figure for new mortgage loans has fallen every month since May, a trend not seen for years.

New mortgage loans in Israel are at their lowest since the country emerged from Covid-19 lockdowns. Last month, the total of mortgage loans taken was NIS 6.089 billion, the lowest monthly figure since June 2020. Although most of the Jewish holidays fell in October this year, the figure is still low – 15% below the new mortgage total for the Jewish holiday season in 2021, according to analysis by the Bank of Israel.

The Israeli real estate market continues to cool down rapidly, and the mortgage figures are harbingers of the trend. Since last May, the figure for new mortgage loans has fallen every month, something that has not happened for years. The new trend is a direct result of the interest rate hikes by the Bank of Israel, and it can be deduced from the numbers that the trend has nothing to do with increased supply of homes, as government officials have tried to argue recently.

Nevertheless, it should be borne in mind that at least up until the most recently published home price index, home process have continued to rise steeply. Although many people have abandoned the housing market, those who have decided to stay in and buy properties have contributed to a rise in prices.

Globes Arik Milovsky October 18,2022

New home sales in Israel hit three-year low

2,780 new homes were sold in August 2022, down nearly 50% from August 2021, the Central Bureau of Statistics New home sales in Israel have hit a three-year low, the Central Bureau of Statistics reports. 2,780 new homes were sold in August 2022, down nearly 50% from August 2021 and down 50% from August 2020. In July 2022, the number of new apartments bought was down 45% from July 2021.

New home sales have been falling by an average of 2.8% per month since October 2021. The number of new homes bought in August 2022 was similar to the monthly numbers of the first half of 2019. New home sales are expected to have continued falling during the holiday months of September and October 2022, and it is possible that new home sales levels will reach the low levels of 201

Central Bureau of Statistics data show that purchase deals for new apartments in Israel are falling faster than for second-hand apartments. At the same time the falling number of new apartments sold is increasing the supply and inventory of available new, which reached 49,300 new apartments at the end of August 2022, the highest number since June 2020.

Another surprising figure was that for the first time in many years the biggest number of new apartments is being sold in Jerusalem. Between June and August 2022, 581 new apartments were sold in Jerusalem, followed by 513 new apartments in Netanya, 506 new apartments in Tel Aviv, 388 new apartments in Lod, 380 new apartments in Beit Shemesh, and 352 new apartments in Rishon Lezion.

Globes – Yuval Nisani November 8,2022

Globes – Yuval Nisani November 8,2022

TAMA 38 projects freeze eased near Metro stations

Israel’s National Planning and Building Commission has ruled that new TAMA 38 permits for urban renewal projects and strengthening buildings will only be frozen for projects within 100 meters of planned Metro stations.

Israel’s National Planning and Building Commission has ruled that new TAMA 38 permits for urban renewal projects and strengthening buildings will only be frozen for projects within 100 meters of planned Metro stations – defined as the core area of the station. Permits for projects within 100-300 meters of planned stations in the Gush Dan region will be considered according to specific criteria, while the freeze on project further than 300 meters from the planned stations will be lifted.

This latest compromise overrules the recommendation three months ago by the National Subcommittee on Basic Planning, which caused a storm of controversy, by freezing all TAMA 38 projects within a radius of 500 meters of planned Metro stations, and insisting that a freeze on projects up to 800 meters from the stations should also be considered.

Globes Yaser Wakid October 18,2022

Globes Yaser Wakid October 18,2022

Treasury official: Israel’s housing market has changed

Although the discrepancy between rising prices and declining deal numbers is hard to explain, Galit Ben Naim insists “this is not the same market as we saw in 2021”.

Figures released by the Central Bureau of Statistics last Friday showed home prices rising at a rate not seen for more than a decade, of 19% in a year. This is despite sharp interest rate hikes by the Bank of Israel, and reports of a decline in sales and of other indicators of a cooling market.

Nevertheless, the Ministry of Finance is sure that the Central Bureau of Statistics numbers do not necessarily portray an overheated market. “The home prices index for July-August published by the Central Bureau of Statistics produced many headlines, some of them inaccurate, such as those declaring that people are continuing to snap up homes,” says Galit Ben Naim, a manager in the Ministry of Finance Chief Economist Division.

“In August, the decline in the number of transactions in both new and secondhand homes continued, and even gathered pace. The total was 8,300, which represents a 41% decline in comparison with August 2021. Excluding purchases under the Buyer Price program, the number of transactions was 7,800, 38% fewer than in August last year, and 12% fewer than in the preceding month,” Ben Naim says.

According to Ben Naim, in a post on her Facebook page, the sharp decline in transaction numbers did not spare the contractors, who sold 2,900 homes in August this year, 44% fewer than in the same month last year. “If these digits look familiar, perhaps it’s because the new home price index published by the Central Bureau of Statistics showed a 4.4% rise in July-August. Incidentally, sales by contractors in July-August were the lowest since the nadir recorded when the Covid-19 pandemic broke out,” she write

Globes September 5 2021

Globes September 5 2021

Sold in Tel Aviv and the area

Tel Aviv: A 135 square meter, five-room, second floor apartment with parking and an elevator on Burla Street in Tochnit Lamed was sold for NIS 4.4 million. A 100 square meter, four-room, fifth floor apartment with an elevator and parking on Dimona Street in Yad Eliyahu was sold for NIS 2.53 million (RE/MAX – Ocean). A 100 square meter, four-room, ground floor apartment with a 25 square meter garden, elevator and parking on De Haz Street in the Old North was sold for NIS 5.37 million. A 120 square meter, four-room, first floor apartment with parking and an elevator on Lessin Street was sold for NIS 5.4 million. A 104 square meter, four-room, first floor apartment with an elevator and parking on Block Street was sold for NIS 4.85 million (Anglo-Saxon)

Holon: A 59 square meter, three-room, third floor apartment with parking and an elevator on Dov Hoz Street was sold for NIS 1.5 million. A 87 square meter, 3.5-room, second floor apartment with parking on Ha’ma’apilim Street was sold for NIS 1.45 million. A 107 square meter, five-room, fifth floor apartment with an elevator and parking on Baratz Street was sold for NIS 2.13 million (RE/MAX – Evanav).

Rishon Lezion: A 100 square meter, four-room, third floor apartment with an elevator and parking on Siterman Street in the Nahlat Yehuda neighborhood was sold for NIS 2.7 million. A 94 square meter, four-room, third floor apartment with an elevator and parking on Hashomer Street in the Bilu neighborhood was sold for NIS 1.84 million (RE/MAX – Ideal).

The Marker – Adar Horesh Sept 2021

The Marker – Adar Horesh Sept 2021

“We are at the start of a wave of rising apartment prices – which will not stop for the next seven years”

Hanan Moore, the majority owner of the state-owned company that struck a huge deal in the Sde Dov district, is convinced the economic bet was justified, explains why he decided to stop building outside Gush Dan and says he has a plan to deal with the increase to double the company’s debt.

It was one of the surprising victories: Hanan Moore, a mid-size construction company focused on popular construction and price per tenant projects, won a significant portion of the prestigious housing tender in the area. who was evacuated about a year ago from Sde Dov – the airport north of Tel Aviv.

According to forecasts, there will be a neighborhood for the rich only in the area. The ministries of housing and finance see the commercialization of state land in the region as a source of revenue amounting to billions of shekels. The Tel Aviv municipality’s request to allocate social housing to the needy in the complex was also dismissed with contempt by the finance ministry. In an attempt to moderate criticism of the Millionaire Gulf, planning authorities allocated several hundred apartments for affordable housing, but those plans were also ridiculed by Rash. For most Israelis the new neighborhood will be unaffordable. Rental prices will be determined based on market prices, and the monthly rent will be about half of an average salary. The thousands of apartments to be built in the complex are estimated to be the most expensive in the country. Mid-size apartments with an area of 100 square meters will be marketed at a price of NIS 7-7.5 million. Pentouses will be mentioned in articles about celebrities in Israel. The neighborhood will also have smaller apartments of around 70m2, which will be offered at a lower price of NIS 5 million. The prices of course reflect the current state of the housing market, while the apartments are not expected to start being occupied until 2025.

Moore’s victory was also surprising in terms of the volume of the new deal relative to the size of the company. Hanan Moore (-0.78% 5109) is expected to pay NIS 1.46 billion for the land. The project will include around 500 apartments, 1,000 m² of commercial space and a small hotel of 1,500 m². The construction cost is estimated to be between 600 and 700 million additional NIS. The investment required is three times its value

Globes May 30 2012 – Arik Mikovsky

Globes May 30 2012 – Arik Mikovsky

The rise in home buying in Israel was led by investors who bought 2,500 apartments in March 2021, up 114% from March 2020.

13,200 homes were sold in Israel in March 2021, according to the Ministry of Finance Chief Economist, up 38% from March 2020 and up 26% from February 2021.

The rise in home buying was led by investors who bought 2,500 apartments in March 2021, up 114% from March 2020 and up 17% from February 2021. 6,600 young couples bought homes in March 2021, the largest number of first time buyers since 2017.

Investors have been returning to the real estate market after the government lifted the purchase surtax last July, which was imposed in 2015 by then Minister of Finance Moshe Kahlon, for homebuyers who already own homes purchasing additional properties.

The latest report by the Ministry of Finance Chief Economist examines who are the people investing in more than one Israeli home. The examination found that 14% of those investing in an additional property were company owners, 9% were pensioners, and 20% were receiving a pension but continuing to work in a salaried job (such as retired army and police officers). 69% of the investors were couples in which at least one of the couple had a salaried job, while 22% of the investors in which at least one of the couple was self-employed, and in most cases the second was a salaried employee.

The 14% of those buying homes for investment who were company owners had an average gross monthly income of NIS 129,000 per month while the pensions (including those still working) had an average gross monthly income of NIS 64,000 and the self-employed had an average gross monthly income of NIS 57,400, while the salaried employees had an average gross monthly income of NIS 46,600. The pensioners, who had no other income, had an average monthly income of NIS 27,500.

38% of investors in real estate in March worked in the public sector – in other words most of the salaried employees. Surprisingly only 9% of buyers in Israel investing in an apartment in March worked in high-tech.

51% of investors in March live in Tel Aviv and central Israel, 21% in the north and south, 22% in the Haifa district and only 6% in Jerusalem.

The average price of an apartment bought by an investor in march in the Tel Aviv District was NIS 1.84 million, in the Central Region NIS 1.81 million, in Judea and Samaria NIS 1.36 million, in Jerusalem NIS 1.3 million, in the south NIS 1.28 million, in Haifa NIS 1.24 million and in the north NIS 1.09 million.

The average age of investors was 52 and only 25% of investors were younger than 42, the Chief Economist of the Ministry of Finance found.

Globes April15 2021 – Guy Ben Simon

Globes April15 2021 – Guy Ben Simon

CPI up 0.6% in March, housing prices still rising

Israel’s Consumer Price Index (CPI) rose 0.6% in March 2021, the Central Bureau of Statistics reports, slightly higher than the analysts’ consensus of 0.5%. Since the start of 2021, the CPI has risen 0.8% and over the past 12 months, the CPI has risen 0.2%. The high inflation figure for March would seem to suggest a return to normalcy after 12 month in which the Covid-19 pandemic has hit economic activity.

There were significant price rises in March in clothing (5.8%), entertainment and culture (2.2%), transport (0.9%), and furniture and household equipment (0.8%). There were significant price falls in fresh fruit and vegetables (1.5%).

The housing prices index, which is separate from the CPI, continued to rise in the period January-

February, in comparison with December-January, climbing by 0.3%. Housing prices have risen 4% over the past 12 months.

During January-February compared with December-January, housing prices in the south rose 1.1%, in Haifa 0.9%, in Central Israel 0.8%, in the north 0.5%. Over this period prices fell 0.2% in Tel Aviv and fell 0.6% in Jerusalem.

Over the past 12 months prices have risen 5.4% in the north, 4.5% in Central Israel, 4.3% in the south, 3.9% in Tel Aviv, 3% in Haifa, and 1.2% in Jerusalem.

The Marker – April 14 2021 by Ada khoresh

The Marker – April 14 2021 by Ada khoresh

New apartment prices are soaring at a double-digit annual rate. But there is a hint of hope

Two years of paralysis of government work and the freezing of budgets have hit the housing market hard – and the result is already felt at dizzying prices

In a Year: This is the rate of price increase that reflects the four indices of housing prices published today (Wednesday) by the Central Bureau of Statistics (CBS). It is doubtful whether the latest figure – price increase of only 0.3% in January-February – indicates a change in trend: Significantly, and industry-accepted estimates range from a 10% to 15% increase.

According to data released this week by the Ministry of Finance, buyers are not only homeless young people and older people who are improving housing, but also investors who have increased their activity – approaching 20% of the market, with purchases of more than 6,000 apartments in one quarter.

The real estate market is heating up all over the world due to low interest rates and inflows of money into markets by countries that tried to prevent an economic crisis during the Corona period. With a 3.8% increase between the last quarter of 2019 and 2020, Israel occupies a good place at the bottom Luxembourg (3.9%), followed by Luxembourg, with an annual price increase of 16.7%, followed by Denmark (9.8%) and Lithuania (9.4%), followed by Malta (1.7%), Italy (1.6%) and Ireland.

At least in Israel, the signs point to continued price increases – and even acceleration. The main reason for this forecast is the shortage of apartments for sale, which is already being felt in the market. Two years of paralysis of government work, which is the main factor influencing the volume of construction, and the freezing of replica budgets required for development – have severely hampered the activity of the industry. Even if a government is formed in a few months, it will not be able to change the situation in the short term. 2021 is expected to be another year of disrupted activity in the construction industry, and the deepening of the ongoing shortage accelerating the rise in housing prices.

A significant portion of the housing market relies on state land and government subsidies for infrastructure and development. Lack of infrastructure prevents the marketing of land for construction. Land marketing was frozen for several months last year in the absence of a budget, but even the release of budgets did not solve the problem over time. In the last two weeks, the state has almost completely stopped marketing land, and the supply of land ready for tender is extremely low.

The result is already noticeable in the dizzying prices of the few plots that are still offered for sale. The expensive plots will only become homes in three years, but the developers, who see before their eyes the prices of the plots that they will have to purchase further down the road, are raising the prices of the apartments already now. The rapid reaction of the contractors is evident in the price index of new dwellings, which rises more sharply than the general index of dwellings. The cumulative increase in the housing price index in four months reached 3.8%: an annual rate of about 11.5%.

The gap between the indices is also affected by the depletion of the stock of subsidized apartments in the market, with the cessation of the “price per occupant” program, which was replaced by the reduced program “housing at a reduced price”.

A chance of a certain restraint in the rate of increase in housing prices can be identified precisely in the general price index, which begins to arise after a prolonged slumber. The rise in the index, apparently caused by international factors such as rising commodity prices, fuel and maritime transport, may trigger a trend of rising interest rates – which will cool real estate and capital markets. But even this trend, if developed, will not solve housing market problems and comfort The young families, who will pay the price of the stated interest

Globes – Feb 11 by Arik Mirovsky

Globes – Feb 11 by Arik Mirovsky

Housing sales in Israel hit 20-year high in 2020

62,000 homes were sold in the second half of the year, the Ministry of Finance Chief Economist reports.

In 2020 there were 107,100 housing deals, while of the highest numbers in recent years. 62,000 of the deals were in the second half of the year, the highest number of homes sold in a six month period for 20 years, according to the residential real estate survey published by the Ministry of Finance Chief Economist office.

2020 was an exceptional year in every sense of the word. Residential real estate sales in the first two months were very strong, continuing the trend from 2019. But then the Covid-19 pandemic struck and sales plunged between March and May before slowly recovering with an unprecedented boom in the second half of the year, further boosted by the government’s cut in purchase tax on owning more than one home, which drew investors back into the market.

The boom culminated in December with 13,400 housing deals – a number only exceeded in June 2015 and December 2013. In December 2020, buyers included large numbers of investors, young couples, and people moving up to bigger homes. Investors bought more than 2,000 homes a month in the final months of the year, moving towards the levels before 2015, when the then Minister of Finance Moshe Kahlon introduced higher purchase tax for investors..

December 2020 was a particularly good month for building contractors with 5,400 new homes sold including as part of the Government’s Fixed Buyers Price program. In the second half of 2020, 38% of all housing deals were for new homes.

In December 2020, young couples bought 6,200 apartments, including 1,600 as part of the Fixed Buyers price program and the highest number for more than 10 years and since the 2011 social protests against the high cost of living and lack of affordable housing.

Most experts expect the boom to continue in 2021 with prices expected to rise 3%-4% over the next year, according to government forecasts.

Adi Cohen The Marker 18/12/2020

Adi Cohen The Marker 18/12/2020

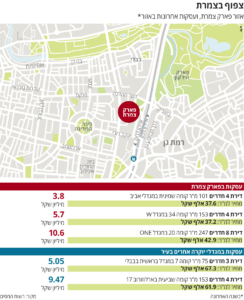

A very interesting item published by The Marker shows us the trend of the Park Zameret neighborhood and where it is going. As well what happens with the Luxury Homes Market in Tel Aviv

For many years and since the beginning of the building of the Yoo Towers designed by the famous architect Stark, attracted the “Famous and the Rich” who bought and lived there such as Bar Rafaeli, Eyal Golan and others who have since moved out of the area. Today there are 10 towers built which add to 1500 apartments for the area located between Ayalon freeway and Dereh Namir.

The prices vary between 38,000 and 43,000 per m2 for resale of the apartments. The high end clientele moved across the street and is buying in Bavli at Bereshit or Park Bavli where prices run around 60,000 per m2.

This happened despite the fact that the GMall built right in the center of the neighborhood and the schools all meant to keep the values. The towers built based to standards already 10 years old “do not cut it” for today’s luxury buyers. As well the owners of the existing apartments did not renew or invest enough to keep the “luxury flair” of the neighborhood.

See the graph comparing prices in Park Zameret and Bavli Towers

See the graph comparing prices in Park Zameret and Bavli Towers

Here are some examples :

Park Zameret – 4 rooms 101m2: 3.8M – 4 rooms 153m2: 5.7M – 8 rooms 247m2 :10.6M

Other Luxury Towers: 3 rooms 75m2: 5.05M – 4rooms 153m3 : 9.47M

So it comes down to how much you can pay and justify why people still buy in Zameret with a feel of Luxury at an affordable price

29 Dec, 2020 Guy Lieberman pour Globes

29 Dec, 2020 Guy Lieberman pour Globes

Home purchases in Israel rose 54% between the second and third quarters of this year, although the rise was unevenly spread.

In the third quarter of 2020, in which Israel had its second lockdown, 25,800 housing units were purchased (excluding the subsidized “Buyer Price” program), representing an 8.6% increase over the third quarter of 2019, and the highest number of transactions for 14 quarters. The figures are from the survey of the Israeli real estate market published by the Chief Economist’s Department of the Ministry of Finance, headed by Shira Greenberg.

“In the third quarter of 2020, there was a substantial recovery in the number of homes purchased, after the sharp fall in the previous quarter, The increase over the second quarter was 54%.But 8% fewer than in the corresponding period of 2019.

The geographical breakdown of the figures shows an uneven picture. “Despite the substantial growth in the number of transactions in the third quarter,” the report states, “in two regions, Tel Aviv and the center, where demand is normally high, the number of transactions continued to decline in the third quarter in comparison with the corresponding quarter of last year.”

In the central region, the number of transactions in the third quarter of this year was 8% down on the number in the third quarter of 2019. In Tel Aviv, the decline was 3%.

The survey notes that this is the third successive quarter that has seen a decline in transaction numbers in these areas. 9,300 homes were bought in the central region in the first nine months of 2020, 17% fewer than in the first nine months of 2019.

The survey also shows that more and more investors are entering the market. “In the third quarter of 2020, 4,300 homes were bought by investors,” the survey states. “This is the highest level for such purchases since the third quarter of 2017.

All the same, the stock of homes held by investors in Israel continues to decline, since veteran investors are selling many homes. Presumably, a fairly large proportion of these homes is being bought by new investors now entering the market.

23 Dec, 2020 13:35 Arik Mirovsky

23 Dec, 2020 13:35 Arik Mirovsky

Tel Aviv apartment rents reach record high

Despite initially depressing the city’s rental market, the Covid-19 crisis only had a fleeting impact.

Tel Aviv apartment rents continue to rise as if the Covid-19 economic crisis hasn’t happened. The only question that remains is whether the trend will reverse when government assistance to the unemployed dries up.

A recent survey by real estate market research company Czamanski & Ben Shahar found that Central Tel Aviv and the Old North remains the most expensive real estate market in Israel with prices falling to the east and south.

A recent survey by real estate market research company Czamanski & Ben Shahar found that Central Tel Aviv and the Old North remains the most expensive real estate market in Israel with prices falling to the east and south

It was only in March that the Bank of Israel identified a sharp rise in the number of apartments for rent in Tel Aviv following the collapse of the Airbnb tourist market and the high number of unemployed young people who had returned to live with their parents during the first lockdown accompanied by a 15% fall in the level of rents being asked. But by April the Bank of Israel noted that the market had stabilized and the latest figures suggest this was all just a fleeting episode.

The results of this trend of everything within a 15 minute radius fits the bill for everything between Tel Aviv’s Yarkon River in the north, the beach in the west, the Ayalon Highway in the east and Florentin in the south. In this rectangle rents can typically be about NIS 104 per square meter or NIS 7,300 for a three room apartment per month, well above the average of NIS 5,766 in the city as a whole. For example, north of the Yarkon River including Kokhav Hatzafon, Hagush Hagadol and Ramat Aviv, the price per square meter is just NIS 86, or 17% less than the city center and Old North, in the southeast of the city rents are even less at NIS 71 per square meter and in the far east of Tel Aviv NIS 65 per square meter, and even less at NIS 64 per square meter in

“Meanwhile the prices aren’t falling. Most businesses, not to mention services or trade, banking, finance, high tech have still not been harmed. A survey by the Students Union found that 20% of students went to live with their parents. Not all of them. And don’t forget that in their place there are new students. In other words, instead of those who left, new customers have come along who have kept the price level high.”

Rent prices also interest real estate investors who are looking for maximum returns on the homes they buy. Tel Aviv still gives relatively low returns on average of 2.6% per year, up from 2.4% three years ago.

The Central Bureau of Statistics also published the Housing Price Index today for April – May.

The Central Bureau of Statistics also published the Housing Price Index today for April – May.

Globes July 17, 2019

The Index showed the price of the average deal rising 0.5% in April-May compared with March-April. Housing prices have risen 1.6% over the past 12 months.

Inflation in Israel was only 0.8% over the past 12 months, the Central Bureau of Statistics reports, decreasing the likelihood of a rate hike.

The Consumer Price Index (CPI) unexpectedly fell 0.6% in June, the Central Bureau of Statistics reported this evening, a much bigger fall than analysts’ predictions, who had expected a 0.2% to 0.4% fall. The CPI has risen 0.8% in the past 12 months, below the Bank of Israel’s annual target range for inflation between 1% and 3%, making an interest rate hike this quarter, as forecast by the Bank of Israel Research Department, much less likely. This follows a 0.7% rise in the CPI in May.

Notable price falls in December included fresh fruit and vegetables (11%), clothing and footwear (6.2%) and furniture and household equipment (0.6%).

The Basel area is going to pick up even higher value.

The Basel area is going to pick up even higher value.

The winning consortium of White City Buildings, the JTLV group, and Isrotel will build apartments and hotels.

Globes July 17, 2019

When the envelopes were opened today, a consortium of White City Buildings, the JTLV group, and Isrotel was declared the winner of the Tel Aviv municipality’s tender for selling the land on the Magen David Adom site in Basel Square in Tel Aviv. The winning bid was NIS 261 million. The plan includes demolishing the existing building and construction of 30 apartments averaging 200 square meters each on the three-dunam (0.75-acre) site. The project also contains hotels and health and spa facilities, such as a swimming pool, a fitness room, concierge services, and special commercial areas for the hotel guests and tenants on the site.

Investors in the joint fund, which raised NIS 750 million in the initial closure, include Bank Hapoalim, Clal Insurance, and Meitav Dash Investments.

Isrotel will provide management services for the site, making the services and conditions provide by the hotels to their guests also available to the tenants on the site.

Shoham said, “It is a great privilege for White City Buildings to continue leading innovation in Tel Aviv. The boutique project on the Basel site will create an innovative mixture of uses, including a hotel and excellent residences. The successful cooperation with Isrotel and our connection to the city and its values will help us build one of the most important compounds ever constructed in Tel Aviv.”

Isrotel CEO Lior Raviv said, “This is another important step in our entry into the urban hotel business in Tel Aviv. The location is unique, and the combination of a hotel on the highest level and luxury dwellings is perfect. Our goal is to continue consolidating our position in the hotel industry in Tel Aviv, and the hotel on Basel is another step in this direction.”

New-minted transport minister Smotrich: Sde Dov will not close

New-minted transport minister Smotrich: Sde Dov will not close

Globes June 18,2019

Betzalel Smotrich’s first stop after being appointed minister of transport was the tent protest against the closure of Sde Dov Airport led by Eilat mayor Moshe Yitzhak-Halevi.

Within an hour of being appointed minister of transport, MK Betzalel Smotrich turned up at the protest tent set up by Eilat mayor Moshe Yitzhak-Halevi opposite the Ministry of Finance in Jerusalem. Yitzhak-Halevi is protesting against the closure of Sde Dov Airport in Tel Aviv, which is scheduled to take place at the end of this month to make way for residential construction, claiming that the closure will drastically impair travel between the center of the country and Israel’s southernmost city.

Smotrich, an enthusiastic supporter of the protest against the airport closure, said yesterday: “Sde Dov must not be closed, and with God’s help Sde Dov will not be closed. This is the first matter I discussed with the prime minister in this very place in his bureau, a moment after this appointment was agreed. Under the wise leadership of the mayor of Eilat, a move is underway that is certainly a mission possible.

“It is very symbolic that my first working meeting in this role is taking place here in this tent in a campaign we have been leading together for several years. Wearing the transport minister’s hat the authority is not in my hands but the responsibility is certainly even more on my shoulders. We will go into this at full power. It’s a just, right, moral and Zionist struggle of the first order. When you conduct a just campaign, you generally succeed. It requires a great deal of determination, and I believe that if we join forces we will succeed in this challenge as well.”

Amiram Barkat – Globes May 15,2019

Amiram Barkat – Globes May 15,2019

CPI up 0.3% in April, housing prices up 0.1%

Inflation was 1.3% in the past 12 months, while due to the latest rise housing prices rose 0.5% in the past 12 months,

The Consumer Price Index (CPI) rose 0.3% in April, the Central Bureau of Statistics reported this evening, lower than expected. The CPI has risen 1.3% in the past 12 months, still towards the lower end of the Bank of Israel’s annual target range for inflation of between 1% and 3%. The CPI has risen 0.8% in the first four months of 2019. This was the third successive month in which the CPI has risen after three successive months before that when it fell.

Prominent price rises in April included footwear (2.4%), fresh fruit (1.5%), transport (1.5%) and culture and entertainment (0.5%).

The Central Bureau of Statistics also published the Housing Price Index today for February-March 2019. The Index showed the price of the average deal rising 0.1% in February-March compared with January-February. Housing prices have risen 0.5% over the past 12 months.

Israel’s Central Bureau of Statistics reports.

Arik Mirovsky in Globes May 14,2019

Arik Mirovsky in Globes May 14,2019

Neve Tzedek lot sold for NIS 17.6m

The Tel Aviv lot is zoned for construction of a building with 10 apartments and a commercial façade.

Dan Real Estate has won an Israel Land Authority auction for the purchase of a 255-square meter lot in the Neve Tzedek neighborhood of Tel Aviv. The lot, located at the intersection of Elhanan Street and Degania Street, is zoned for construction of a building with 10 apartments and a commercial façade. The company will pay NIS 17.6 million for the lot.

A plan called Tafri Neve Tzedek East applies to the lot. The plan, which was approved in January 2018, includes the northeastern part of the neighborhood bordered by Elhanan Street, Talmi Street, and the edge of Rothschild Boulevard. The plan, which covers 35 dunam (8.75 acres), is designed to preserve the neighborhood’s historical construction fabric, which features low construction and a high land cover (buildings that occupy a large proportion of the lot on which they are constructed).

The plan applying to the lot that was sold stipulates a 15-meter high, three-storey building with a commercial façade. The average space of the apartments will be at least 65 square meters. The minimum price in the auction was NIS 5.44 million, and 14 bids were submitted.

Gili Melinsky , May 7, 2019 , The Marker, interview of Oded Gvuli

Gili Melinsky , May 7, 2019 , The Marker, interview of Oded Gvuli

« Tel Aviv has no competition ! Housing prices will only increase says Oded Gvuli, ex-engineer at the City of Tel Aviv Jaffa. He is convinced that the Israel Land Authority disappear and let the Mayors handle the distribution of land and on the way eliminate two thirds of the municipal authorities. Decisions for Planning and Housing should be made by professionals and not by politicians who typically only worry about their next job.”

Oded Gvuli left the Building of the Planning Authority at City of Tel Aviv for the last time and left the title to the new heir, Udi Carmeli. After 11 years on the job, 7 of which as City Engineer, he will, from now on, look at the private sector.

Management at the City planning department ended as a total failure as far as creating a long term strategy. Part of it is because, during too many years, all the decisions for housing strategies were left to the Ministry of Finance with at its head, Moshe Kahlon. The Israel Land Authority and the planning were, as well, left to the Ministry of Finance.

Why didn’t they consolidate Bat Yam and Tel Aviv? I believe this is one mistake of my time on the job. We could have been a beacon for the other cities. We had a social , economical and financial study ready and we were almost there, but politics killed it all. Israel should have 60 Municipalities instead of 255 and then in this way develop on their own an independent economy with low price housing and a lower cost of living. In Tel Aviv EVERYTHING is more expensive!

So is the city ready to let go of the young and the poor and leave Tel Aviv to the rich only?Absolutely not. Tel Aviv is very sensitive on that point and does not want this to happen. But in the meantime, there is no chance to see prices of real estate coming down. Tel Aviv has no competition and prices WILL go up. As long as the city is more attractive the price of land will go up. A liberal, secular, european feel city in Israel today is a city where everything is expensive.

On April 19, 2019 Adar Horesh in The Marker

On April 19, 2019 Adar Horesh in The Marker

Is this how any given balloon ends? Price of homes are going up in areas where most of Israelis want to live.

The index of prices that was published this week by the Central Bureau of Statistics totally wiped out the annual decrease reported lately. Based on data from The Marker and Yad2 the prices for the areas in high demand are rising.

The data published by the Central Bureau of Statistics shows that the program put together by the Minister of Finance, in order to bring prices of homes down, lost terrain. The prices are trending up. The high demand in the Center of Israel area and the low inventory is driving the market up.

The numbers are also showing that the buyers and investors who were on the fence are now getting back to purchasing. The efforts to shorten the wait for planning and permits for the builders failed and the pace of starts of building is still slow. Everybody in the industry is warning about a shortage of inventory and a renewal of the uptrend in prices.

From the Index Data we can see that the prices for the homes for sale went up significantly compared to the month before.

The prices for apartments for rent was stable, but this trend is normal for the winter months considered “slow months” for rentals.

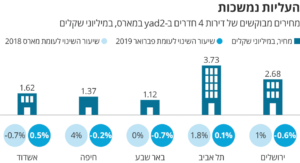

Here is a graph showing the asking prices for 4 room homes – in Yad2, comparing selling Prices in February and March 2019

Also a graph with prices for 3 room rentals March 2018 compared to March 2019

But these numbers don’t necessarily forecast increased prices for the months to come. The Market is influenced by the expectations of the buyers and the sellers; as well the programs the new government might put out would really influence the mood of the players in the Market.

On April 23, Arik Mirowsky in Globes is saying :

Increasing housing supply in low demand locations won’t cut prices when there is a shortage of housing in Tel Aviv and Jerusalem.

The Israel Builders Association has begun a campaign in recent days, including a lecture by Prof. Shmuel Hauser, arguing that if the supply of housing increases, prices will fall.

This campaign relies on the obsessive counting of housing units begun at the beginning of the decade, when housing prices began to rise. This obsession caused damage, a small part of which began to surface recently, but most of which will appear in the coming decades.

The government enthusiastically jumped on the housing shortage bandwagon in order to demonstrate that it was doing something to lower housing prices. Economists also endorsed this thesis, because it was simple and fitted in with simplistic economic models.

In recent years, the overall supply of housing increased, especially in 2013-2015, through accelerated construction, but prices did not fall and the public was in no hurry to buy the new apartments. Spacious apartments built to a high standard in new neighborhoods stayed on the shelf, and not only because the prices were still high. Why? Because the apartments were not built where they were needed. The supply problem in Israel is not universal; it is in special places and specific sectors.

There is no lack of housing in the Krayot region north of Haifa, or in Harish (actually, the secular population did not need Harish), or in Dimona, Beer Sheva, or Akko. There is a shortage of housing in Tel Aviv and Jerusalem, in haredi (Jewish ultra-Orthodox) communities, and in Arab communities. These are exactly the places where not enough housing was built.

Most of the activity aimed at increasing the supply of housing created a phony supply of housing of no relevance to the country, to no one’s benefit in the near future. On the other hand, demand pressure in the places that are relevant will continue. We will pay the price of the unneeded supply and the missing supply in the next housing crisis.

Shlomit Tsur 3 April 2019 Globes

Shlomit Tsur 3 April 2019 Globes

Sde Dov Airport is slated to halt operations in November 2019 despite a public campaign against the closure led by the Tel Aviv and Eilat mayors.

The Tel Aviv District Planning and Building Commission in the Planning Authority today deposited for public objections the plan for a Sde Dov residential neighborhood in place of Sde Dov Airport in north Tel Aviv. The plan applies to 2,500 dunam (625 acres), The site is bordered by the Reading power station on the south, land in northwest Tel Aviv on the north, and the Nofei Yam and Lamed neighborhoods on the east.

Under the deposited plan, 16,000 housing units will be built on the site, including

6,900 rental apartments at reduced rents, assisted living facilities, and student apartments. The plan also includes

514,000 square meters of public buildings,

126,000 square meters of commercial space,

323,000 square meters of office space,

200,000 square meters of hotel space,

3,700 hotel rooms, and

385 dunam (96.25 acres) of public parks and gardens.

The proposed construction includes 5-10-floor buildings along the main streets and 35 towers of up to 40 floors along the main arteries in the site.

Sde Dov was founded as a civilian airport in 1938 north of Tel Aviv, near the Reading area. Part of it later became a military airport, and the area now contains a military base and a civilian terminal.

The government reaffirmed the Sde Dov law in June 2018 and decided that the military airport would be vacated by July 2019 and the civilian airport by November 2019.

On April 1 2019 Arik Mirowsky in Globes is writing

The difference in housing prices between Tel Aviv and the rest of the country has risen from 56%, 30 years ago to 120% now, according to the Central Bureau of Statistics.

The phrase “the state of Tel Aviv” refers to many things. In real estate, it refers mainly to the growing difference in housing prices between Tel Aviv and the rest of the country, especially the outlying areas. 30 years ago, average housing prices in Tel Aviv were 56% higher than in the rest of Israel. Today, the difference is 120%, according to the Central Bureau of Statistics.

The surge in real estate prices hit the outlying areas in 2009, while the government began to act, or at least to say that it was acting, to lower prices. Former Ministers of Finance Yuval Steinitz and Yair Lapid failed, while current Minister of Finance Moshe Kahlon only managed to halt the upward price spiral. Real estate prices in Tel Aviv now average NIS 2.7 million: 1.5 times the average in Jerusalem, 2.5 times the average in Haifa, and triple the average in the outlying areas in northern and southern Israel.

The state of Tel Aviv has completed its real estate triumph.

On January 27 2019 Shlomit Tsur and Arik Mirovsky in Globes are giving us the details of a few apartments sales that closed in Tel Aviv :

A 130 m2 – 4 rooms – 4th floor (with elevator) on Heh B’Iyar (Kikar Hamedina – New North) sold for 4.8M NIS – This price is certainly for a property needing all new remodeling and that could sell once redone for 6.5M or more.

A 80m2 – 3 rooms – 2nd floor (no elevator) – Hahalutzim St (Florentin) sold for 2.56 M NIS. Absolutely within the price range in the neighborhood.

A 153 m2 – 5 rooms- 42nd floor (tower building) in Park Zameret sold for 6.52 M NIS. Confirming the trend of lower cost at buying but very high maintenance fees.

A 73 m2 – 3 rooms – 2nd floor (no elevator) on Bilu street (Heart of the City neighborhood) – Steps from Habima square sold for 3.07M NIS.

These prices just confirm that the market is steady certainly not coming down

Leumi: Housing Prices in Jerusalem and Tel Aviv to rise.

Leumi: Housing Prices in Jerusalem and Tel Aviv to rise.

However, prices are likely to fall in southern Israel and Haifa: Bank Leumi Economists predict

Arik Mirovsky – Globes – Feb 7,2019

Housing prices will not fall substantially in the near future, and may very well rise in high-demand areas like Tel Aviv and Jerusalem. Prices are likely to fall in the southern and Haifa districts, where substantial excess supply has accumulated in recent years, according to a residential real estate survey by Bank Leumi (TASE: LUMI) chief economist Dr. Gil Bufman and analyst Alon Kreis.

The long-term rise in housing prices in Israel came to a halt over the past year. As of November 2018, the Central Bureau of Statistics’ general housing prices index was down 2.3% from its level from a year before.

The number of homes built in recent years was relatively large, but Bank Leumi’s economists examine whether the homes correspond to the level of demand in different regions. Their conclusion is similar to previous studies in the sector. In Jerusalem and Tel Aviv, there is major demand pressure, meaning that the supply does not meet the demand for homes. The situation in the central district is more balanced, with a tendency towards demand pressure. The situation in the northern district is evenly balanced between supply and demand, while excess supply has accumulated in the Haifa and southern districts, because construction there is higher than housing needs.

The economists make a distinction between “the Buyer Fixed Price Plan market, in which growth is rapid, with most of the housing starts and deals taking place in it, and the free market, in which the volume of sales is in a prolonged decline, combined with a drop in housing starts.” In the second half of 2018, the number of new homes purchased rose again, following an increase in purchases in the Buyer Fixed Price Plan framework. On the other hand, the weight of move-up buyers and investors in the market is falling. The survey states that the reduced weight of these two segments in the housing market accounted for the fact that the steepest falls in prices over the past year were in the Jerusalem and Tel Aviv districts. Demand in these two districts is very dependent on wealthy investors, who vanished from the market, causing a sharp drop in demand for housing.

“Looking ahead, the stabilizing trend in housing prices, or at most a moderate decrease, is likely to continue, with support from housing completions. This is likely to remain at the minimum level necessary to fulfill Israel’s regular housing requirements, 50,000 homes a year, for the next year or two, or slightly beyond that. At the same time, the housing price trend in the medium term will depend on government’s housing policy and the macroeconomic environment,” the Bank Leumi analysts conclude. They predict that prices will behave differently according to district, meaning that prices will fall in Haifa and the south and rise in Tel Aviv and Jerusalem.

The Electric Company of Israel is releasing land in Tel Aviv

750 apartments will be built in Ramat Ahayal in the framework of the “lottery” for young couples

Yael Darel – The Marker – Feb 5, 2109

This project of building 750 apartments in this program is part of a signed agreement between The Electric Company and the Israeli Land Authority

This agreement includes 16 sites in great locations including around Reading. As per the agreement they have been already released to the government in October 2018

The Israeli Land Authority is saying that this project will allow the connecting of areas which are presently disconnected by the Electric Company Compound. This will allow an open flow North-South which will benefit Tel Aviv and the whole region

The value of this land as off today is abou 1.7 Billions Shekels and the symbolic agreement was signed today between : the Ministry of Finance – Moshe Kahlon – , the President of the Electric Company Iftah Ron Tal -, The City Manager – Adiel Shamron-, and the Head of the Israeli Land Authority – Menahem Liebe

Even with the property tax (Arnona) doubled, nothing is going to change : Tel Aviv is on its way to become like Eilat.

Meirav Moran – The Marker Jan 28, 2019

Tel Aviv City Hall decided yesterday that the owners of apartments declaring that they use their properties like a hotel, will have to pay a tax of 120 NIS per square meter/per year. This is for this tax an increase of that would vary from to 3 to 4 times as much as it used to be

It sounds like a lot but in fact, it represent an increase of just a few hundred NIS per month per apartments. This change will not scare away the owners who rent out their properties between 500 and 3000 NIS per night

And for those that use a few apartments to run such a business, it will not count much taking into account that their turnover represents thousands of NIS per month. On top of it, the neighbors at this point cannot go and complain at the City for the nuisance due to such a business. The City is now being paid and cannot forbid it.

This law is very convenient for the owners who until now were not “legitimate”, they can from now on run their business legally and rent their apartments thru Airbnb

With this legalization , Tel Aviv who offers a nice and comfortable lifestyle is now becoming like Eilat with a majority of its residents being tourists along with restaurants and hotels.

Good Luck

“AIRBNB is growing on Steroids” spread all over Tel Aviv and makes prices of properties go up.

Gili Malinsky – The Marker Economics News – Jan 18,2019

What started as an alternative that would attract tourists, became this last year a huge phenomena in Tel Aviv. Tel Aviv surpassed Amsterdam and even Barcelona. And this industry impacted the local rental market

The City in a very short message, this week, announced that there will be a change in the property tax for people who rent their apartments. In fact this is a war against Airbnb. The City announced that whoever rents his apartment on the Airbnb platform or any other platform, for more than 90 days per year, will stop being taxed at a residential tariff but at least 3 times as much just like for 4 or 5 stars hotels.

This decision came after residents complaining about their neighborhoods being invaded by tourists that changed the essence of their streets. Especially when we speak with young families who are trying to find apartments for rent and look for months before finding one.

More and more apartments are being rented on Airbnb these last two years as if “on Steroids”. The City is saying that Tel Aviv needs such an option but we have to find a balance to please everybody.

It is not just « an impression » a Study was made by the City Halls of touristic cities with the Socio economic center of Study, and it shows that if we compare: we have in Tel Aviv 1 apartment on 25 rented to tourists, in Amsterdam 1 on 45 and in Barcelona 1 on 78

As per the City this is a very lucrative business : the average price (3 rooms) is 186$ per night and could run up to 8500$ for luxury apartments in the Towers.

As per Bloomberg study on tourism in 2018, Tel Aviv is number 4 for the most expensive city. This would explain why the owners discovered a new and huge appetite for Airbnb

In Tel Aviv 7% of the tenants represent 41,5% of the apartments on Airbnb. In fact, 191 renters count for the 3000 apartments presented on Airbnb

Dec 30, 2018 The Marker _ Yael Darel

Des tours à Kikar Hamedina : après 20ans de discussions finalement Les tracteurs sont en route pour commencer à creuser. Le projet énorme pour 3 tours de 40 étages et environs 450 appartements. La prochaine étape: le permis de construire. Egalement un immeuble commercial de 10 étages , un lac artificiel et des parkings.

Le projet initial d’une route souterraine sous le Kikar est abandonné à cause de toutes les oppositions y compris celle des résidents du Kikar.

C;est un chantier d’environs 1 milliard de Shekels